Reports make clear – US imperialism top dog in Australian economy

Written by: Danny O. on 23 July 2020

The level of Australia’s economic integration and dependence on the United States has been made abundantly clear in two recently released reports.

The level of Australia’s economic integration and dependence on the United States has been made abundantly clear in two recently released reports.

The first, Building Prosperity: The importance of the United States to the Australian economy, was commissioned by the American Chamber of Commerce in Australia (AmCham) and funded directly by the US State Department.

The second, Enduring Partners: The US-Australia investment relationship, was written by right-wing former Australian economics journalist David Uren for the United States Study Centre (USSC) at the University of Sydney and funded by the American Australian Association, a leading privately funded organisation of the US lobby in Australia established by the Murdoch family patriarch, Keith Murdoch in 1948.

In other words, the two reports taken together represent nothing less than US imperialism spelling out the size and scope of its hold on the Australian economy. Along with a similar report from the USSC and AmCham released in 2017, it’s an ongoing attempt to counter the commonly held but mistaken belief that the Australia-China economic relationship is deeper and more significant than the US-Australia relationship.

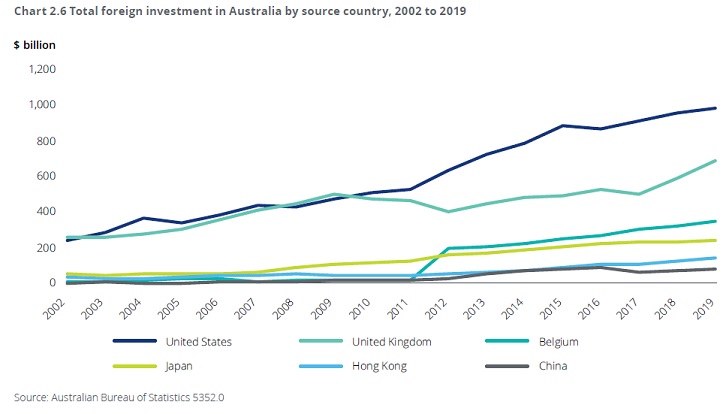

In a recently conducted survey by the USSC, 71% of people mistakenly nominated China as the largest foreign investor in Australia, while only 17% correctly identified the United States as number one. It wouldn’t be a hard mistake to make given the constant barrage of China-bashing and fear mongering coming from the mass media and politicians, but the statistics paint a starkly different picture.

USA #1

The Enduring Partners report states, “Australia has been resource-rich but capital-poor for most of its history, hungry for foreign capital to fuel its economic development. The United States is Australia’s largest foreign investor… Australia’s most indispensable and resilient economic partner.”

Investment from the United States makes up more than 25% of all foreign investment in Australia. At the end of 2019, that amounted to a total of $984 billion. Not only is it the largest single investor by far, over recent decades its investment stock has been growing at a faster rate than overall foreign investment to the country. In the 15 years since the Australia-US Free Trade Agreement came into effect in 2005, the amount of US investment in Australia has almost tripled.

China on the other hand, ranks just 9th (5th including Hong Kong) with only 2% (5.7% incl. HK) of total foreign investment in Australia.

The Building Prosperity report calculates that “7% of Australia’s GDP in 2019 was the direct result of US trade and investment”, or $131 billion. To put that in comparison, its approximately equivalent to the share of GDP attributed to the entire mining sector in Australia.

And what does the US invest in? In 2019, nearly 50% of US foreign direct investment was in mining and manufacturing alone, while the other half was spread out over a number of financial and services industries.

That large portion of investment in mining (which includes gas) is important to note. Australia’s trade is heavily lopsided to the export of raw materials and energy resources, most notably to China and Japan. However, it is often US investors who stand to gain the most from that trade as US multinationals are heavily invested in the resources sector.

The LNG industry is a prime example. “US investment in Australia’s mining sector has helped drive the surge in liquefied natural gas (LNG) exports over the last five years,” states the Building Prosperity report. As Australia competes for the world’s largest exporter spot, US giant Chevron is the single largest holder and producer of LNG in Australia. That investment, far from benefitting ordinary Australians, sees the economy distorted so much that plans are underway to import LNG as there isn’t enough to meet domestic demand because the multinationals are making a bigger killing selling it overseas, rather than using it to meet the needs of the Australian people. Then there’s the pervasive tax dodging.

But you won’t find facts like those in either of the reports.

Economic dependence underpins total subservience

At the launch of the Building Prosperity report, US ambassador to Australia Arthur B. Culvahouse Jr. said, "There's been this notion that you can have economic security on the one side and strategic security on the other. What this report shows is that they are one and the same."

To put it another way, Australia’s economic dependence on US imperialism is inseparable from our subservience to US interests politically and militarily also.

While China is far and away the largest market for Australian exports in trade and our largest trading partner, the US is head and shoulders above the rest of the field when it comes to holding it over Australia’s economy. Therefore, it should not be hard to comprehend Australia’s recent actions in loyally following the United States in souring our relationship with China, or ramping up military spending to prepare to go to war to defend US interests in the region.

They are the actions of a country that is enmeshed in the economic, political, social and military web of US imperialism. Although some cracks are starting to form, the loyalties of the Australian bourgeois ruling class remain overwhelmingly with US imperialism.

The working class struggle for socialism in Australia must inevitably come up against this reality of Australia’s dependence on, and subservience to, US imperialism. Ours is a struggle for independence and socialism.

Print Version - new window Email article

-----

Go back

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Articles

| Madeleine King: Helping the Pentagon to our nickel |

| Binskin appointment comes with a conflict of interest |

| “Grey-Zone” intelligence assessments and real-war scenarios |

| As Australia aids Israeli genocide, Elders say it’s time to target Pine Gap. |

| MUA HERE TO STAY - supporting their members and the Palestinian people |

| US submarine visits not welcome and will never be “normal” |

| A tale of two payments… |

| AUKUS: Jobs diversion scheme |

| Transparency: who will the Australian Government listen to? |

| Australia surrenders sovereignty again: integrates with US-UK military exports and RnD |

| Cancel the Elbit contract! |

| ADF in trouble as personnel leave in droves |

| Heads must roll to clear Defence of US loyalists |

| January 26, what’s to celebrate but struggle? |

| The eclipse of economic rationalism? |

| Can Australian workers manufacture electric cars? Yes we can – dump the nuclear subs. |

| US wants Australia to stockpile the weapons it would need for war with China |

| Military Satellite Project JP1902: Class and State Power in Australia |

| Imperialist Rivalry Plays Out in Fight for Control of Australia's Rare Earth Minerals Deposits |

| Will US base new Typhon strike weapon in Australia? |

-----